Commercial real estate valuation pdf

PDF This paper investigates the role of fundamentals and investor sentiment in commercial real estate valuation. In real estate markets, heterogeneous properties trade in illiquid, highly

2 Master of Science thesis Title Value of Commercial Real Estate investments: Sustainability perspective in Sweden and France. Authors Daria Bryunina

Types of commercial property. Commercial real estate is commonly divided into six categories: Office Buildings – This category includes single-tenant properties, small professional office buildings, downtown skyscrapers, and everything in between.

Two of the three main methods of valuation used by commercial valuers, when used together, will give a reliable commercial real estate value figure to offer as either a selling or a buying price for a commercial property.

19/07/2018 · The value of commercial real estate can be assessed using a variety of different methods and techniques. The cost approach, market approach and income capitalization approach are the three most

Valuation & Advisory Services has the resources to help solve any valuation-related real estate and business challenge. Our services range from single asset valuations to the valuation of multi-market and multi-property portfolios.

Principles of Commercial Real Estate Valuation Summary of Commercial Real Estate valua-tion methods and how the different methods can influence value • Comparable buildings • Capitalisation of yields • Open Market Values • Discounted cashflow valuation methods Occupational lease terms – examples from selected markets, and how this affects value Yields in Commercial Real Estate

Zaxia is an online valuation system for commercial real estate. It is designed and field-tested by experienced commercial appraisers. With your inputs, our ten-minute survey generates a step-by-step analysis using proven methods of valuation. Try Zaxia now.

Blyncc brings commercial real estate software analysis to iOS devices with its flagship TheAnalyst app. The app bundles financial calculators, investment analysis tools, and PDF reporting. Handy features include an amortization calculator and property distance measuring.

Real Estate Assets Produce professional valuation reports and investment appraisals based on industry-standard DCF and Capitalisation valuation methodologies – ideal for commercial…

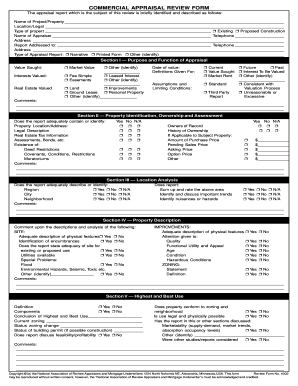

Commercial Appraisal Desk Review Notice of Use: The appraisal Desk Review form assists the Reviewer in determining if the appraisal is well written, the calculations are correct, the reasoning is sound, and the value conclusions are well supported.

Sample Summary Appraisal Commercial Complete Index

The Valuation of Green Commercial Real Estate- Print + PDF

Report on commercial real estate and financial stability in the EU – December 2015 Contents 2 In past financial crises, unsustainable developments in commercial real estate (CRE) markets in some European Union (EU) countries resulted in severe losses for the financial system, possibly also with consequences for the real economy. CRE markets tend to be significantly more cyclical than

used for the sole purpose of assisting the client in determining value for underwriting a real estate loan. Therefore, the intended use of this appraisal is to assist our client, First National

1 Commercial Real Estate Valuation: Fundamentals versus Investor Sentiment Introduction Classical finance theory posits that prices of assets traded in relatively frictionless markets reflect

Commercial Real Estate Valuation: Fundamentals versus Investor Sentiment by Jim Clayton*, David C. Ling**, and Andy Naranjo*** October 2007 Latest Revision: April 2008 Abstract This paper investigates the role of fundamentals and investor sentiment in commercial real estate valuation. In real estate markets, heterogeneous properties trade in illiquid, highly segmented and informationally

working knowledge of the core elements, tools and processes of commercial real estate valuation applicable to retail, office, and special trading properties, as well as development land. It covers: introduction to commercial valuation; lease contracts; income approaches to valuation; comparable sales approaches; valuation reporting.

CBRE’s Valuation & Advisory Services professionals are the leading valuation, advisory and consulting authorities in the real estate industry. Investment and commercial banks, financial institutions, corporations, superannuation funds, investors, property owners, REITs and government agencies from around the globe use our services to meet their business objectives.

Realty Advisors Residential and Commercial Real Estate Appraisers have provided our clients with accurate and reliable real estate appraisal s Learn More >> O ur appraisal reports include well supported fair market value conclusions, completed by a qualified Larimer County commercial real estate appraiser.

The sales comparison approach is a popular and common valuation methodology for real estate. Yet, there are many nuances to the sales comparison approach for commercial real estate …

Find commercial properties for lease in Australia. View the latest commercial real estate listings of Australia properties for lease.

The sector is still battling the trifecta of potentially higher rates, an aging real estate cycle, and the market’s focus on growth over value (though this last leg of the trifecta is showing signs of weakening).

The real estate industry has been shocked and awed at credit’s awesome impact on valuation. Buyers no longer have easy money to purchase real estate, so they can either negotiate the price down,

the commercial and residential real estate literature that the value of a property in a given metropolitan area is a function of demographic, local economic and geographic determinants (Capozza et al ., 2002; Abraham and Hendershott, 1996; Lamont and Stein,

The Income Approach is one of three major groups of methodologies, called valuation approaches, used by appraisers. It is particularly common in commercial real estate appraisal and in business appraisal.

Commercial property Wikipedia

The commercial real estate valuation model template can be used to quickly value a commercial property such as an office building, industrial site, logistics or storage or a retail building via DCF valuation.

This grounds real estate valuation more firmly in modern economics and finance theory and statistical methods as they have developed in recent academic literature. Outline of the argument In an American Economic Review paper,

This paper investigates the role of fundamentals and investor sentiment in commercial real estate valuation. In real estate markets, heterogeneous properties trade in illiquid, highly segmented and informationally inefficient local markets. Moreover, the inability to short sell private real estate

Commercial Real Estate Valuation Software Valuation is an important step an any commercial real estate transaction, but comes with many challenges and risks. Excel is cumbersome and error-prone, and can’t easily model complex lease structures that include reimbursements, expirations, market leasing assumptions, and other standard lease terms.

Real Estate Valuation “Real Estate Valuation” may refer to either (1) valuing individual properties or (2) valuing entire REITs. There’s overlap with some of the methods, whereas other …

This paper investigates the role of fundamentals and investor sentiment in commercial real estate valuation. In real estate markets, heterogeneous properties trade in illiquid, highly segmented

The Commercial Complete real estate database is the most complete real estate database tool available. Flexible, customizable, and powerful, this tool is designed for real estate professionals who need quick access to real estate data.

Approximately half of the total real estate asset value is owner-occupied housing, but that still leaves over trillion in commercial property of various types.

The extent of the assignment given by Jones Lang LaSalle is limited to real estate valuation. This includes office, storage, warehouse, logistics, residential, retail and some extent leasehold properties. – real estate brokerage business plan example The text explains how valuation professionals can identify and value green property features in new and existing commercial properties(2017).Print/PDF

valuation errors in the acquisition or the disposition of properties. Further, the idiosyncratic risk is negatively related to the performance of commercial real estate investments. A 10% increase in the national real estate return would reduce the risk by about 0.8%. This paper seems to make two important contributions to the literature. First, the empirical results provide original evidence

Commercial real estate, which includes o¢ce, retail, industrial, apartment and hotel properties, represents a signi…cant fractionofthe investment universe. 1 The ultimate value of commercial real estate emanates from its rental ‡ow, which re‡ects the

Valbridge is one of Richmond’s largest commercial real estate valuation and consulting firms, with a presence in the market since 2002. Our office specializes in all facets of real estate valuation, including industrial, multifamily, office, retail and residential subdivisions.

Commercial Appraisal TEMPLATE INSTRUCTIONS AND PROCEDURES Please review the following information prior to working in this template. This will be the last place you will be

commercial real estate appraisal appraiser miami-dade broward palm beach south florida real estate appraisal LLC sfreappraisal michael p jacobs mai www.sfreappraisal.com Created Date …

We provide market-driven real estate appraisal and valuation. Whether you are a lender, a developer, or an investor, we will provide you with timely, professional valuation of your single commercial site or your portfolio of commercial properties.

Commercial Real Estate Sample Calculations The following examples illustrate how to use the real estate formulas. In Example No.1 the information is obtained for the property and the financial measures calculated. In Example No. 2 the financial measures such as the Cap Rate are obtained for comparable sales and are used to calculate the Market Value for the subject property. Example No 1. Sale

This commercial real estate valuation model template in Excel can be used to quickly value a commercial property such as an office building, industrial site, logistics, storage or a retail building, via a DCF valuation.

Investor Sentiment and Commercial Real Estate Valuation

Commercial Desk Review Sample Commercial Complete

Example Restricted Appraisal Report South Florida Real

The Income Method of Real Estate Valuation

Three Methods of Appraising Commercial Real Estate Value

Commercial Real Estate Valuation Model Cash Flows

Independent commercial and residential property valuation

https://en.wikipedia.org/wiki/Commercial_property

(PDF) Investor Sentiment and Commercial Real Estate Valuation

– Commercial Real Estate & Property For Lease in Australia

Valbridge Property Advisors National Commercial Real

Valuation in US Commercial Real Estate CiteSeerX

SagePoint Valuation Appraiser Commercial Appraiser

Commercial Real Estate Valuation Fundamentals Versus

Commercial Real Estate Valuation Fundamentals versus

This paper investigates the role of fundamentals and investor sentiment in commercial real estate valuation. In real estate markets, heterogeneous properties trade in illiquid, highly segmented and informationally inefficient local markets. Moreover, the inability to short sell private real estate

working knowledge of the core elements, tools and processes of commercial real estate valuation applicable to retail, office, and special trading properties, as well as development land. It covers: introduction to commercial valuation; lease contracts; income approaches to valuation; comparable sales approaches; valuation reporting.

The sales comparison approach is a popular and common valuation methodology for real estate. Yet, there are many nuances to the sales comparison approach for commercial real estate …

Commercial Real Estate Valuation Software Valuation is an important step an any commercial real estate transaction, but comes with many challenges and risks. Excel is cumbersome and error-prone, and can’t easily model complex lease structures that include reimbursements, expirations, market leasing assumptions, and other standard lease terms.

Commercial Real Estate Valuation: Fundamentals versus Investor Sentiment by Jim Clayton*, David C. Ling**, and Andy Naranjo*** October 2007 Latest Revision: April 2008 Abstract This paper investigates the role of fundamentals and investor sentiment in commercial real estate valuation. In real estate markets, heterogeneous properties trade in illiquid, highly segmented and informationally

The extent of the assignment given by Jones Lang LaSalle is limited to real estate valuation. This includes office, storage, warehouse, logistics, residential, retail and some extent leasehold properties.

The text explains how valuation professionals can identify and value green property features in new and existing commercial properties(2017).Print/PDF

The sector is still battling the trifecta of potentially higher rates, an aging real estate cycle, and the market’s focus on growth over value (though this last leg of the trifecta is showing signs of weakening).

CBRE’s Valuation & Advisory Services professionals are the leading valuation, advisory and consulting authorities in the real estate industry. Investment and commercial banks, financial institutions, corporations, superannuation funds, investors, property owners, REITs and government agencies from around the globe use our services to meet their business objectives.

Valbridge is one of Richmond’s largest commercial real estate valuation and consulting firms, with a presence in the market since 2002. Our office specializes in all facets of real estate valuation, including industrial, multifamily, office, retail and residential subdivisions.

Commercial Real Estate Sample Calculations The following examples illustrate how to use the real estate formulas. In Example No.1 the information is obtained for the property and the financial measures calculated. In Example No. 2 the financial measures such as the Cap Rate are obtained for comparable sales and are used to calculate the Market Value for the subject property. Example No 1. Sale

Real Estate Assets Produce professional valuation reports and investment appraisals based on industry-standard DCF and Capitalisation valuation methodologies – ideal for commercial…

Types of commercial property. Commercial real estate is commonly divided into six categories: Office Buildings – This category includes single-tenant properties, small professional office buildings, downtown skyscrapers, and everything in between.

2 Master of Science thesis Title Value of Commercial Real Estate investments: Sustainability perspective in Sweden and France. Authors Daria Bryunina

Report on commercial real estate and financial stability in the EU – December 2015 Contents 2 In past financial crises, unsustainable developments in commercial real estate (CRE) markets in some European Union (EU) countries resulted in severe losses for the financial system, possibly also with consequences for the real economy. CRE markets tend to be significantly more cyclical than

Commercial Real Estate Valuation Model Template in Excel

Real Estate Valuation Software for Commercial Real Estate

1 Commercial Real Estate Valuation: Fundamentals versus Investor Sentiment Introduction Classical finance theory posits that prices of assets traded in relatively frictionless markets reflect

We provide market-driven real estate appraisal and valuation. Whether you are a lender, a developer, or an investor, we will provide you with timely, professional valuation of your single commercial site or your portfolio of commercial properties.

valuation errors in the acquisition or the disposition of properties. Further, the idiosyncratic risk is negatively related to the performance of commercial real estate investments. A 10% increase in the national real estate return would reduce the risk by about 0.8%. This paper seems to make two important contributions to the literature. First, the empirical results provide original evidence

Commercial Real Estate Valuation: Fundamentals versus Investor Sentiment by Jim Clayton*, David C. Ling**, and Andy Naranjo*** October 2007 Latest Revision: April 2008 Abstract This paper investigates the role of fundamentals and investor sentiment in commercial real estate valuation. In real estate markets, heterogeneous properties trade in illiquid, highly segmented and informationally

This grounds real estate valuation more firmly in modern economics and finance theory and statistical methods as they have developed in recent academic literature. Outline of the argument In an American Economic Review paper,

The sector is still battling the trifecta of potentially higher rates, an aging real estate cycle, and the market’s focus on growth over value (though this last leg of the trifecta is showing signs of weakening).

Commercial Real Estate Valuation Software Valuation is an important step an any commercial real estate transaction, but comes with many challenges and risks. Excel is cumbersome and error-prone, and can’t easily model complex lease structures that include reimbursements, expirations, market leasing assumptions, and other standard lease terms.

The Commercial Complete real estate database is the most complete real estate database tool available. Flexible, customizable, and powerful, this tool is designed for real estate professionals who need quick access to real estate data.

Valuation & Advisory Services has the resources to help solve any valuation-related real estate and business challenge. Our services range from single asset valuations to the valuation of multi-market and multi-property portfolios.

commercial real estate appraisal appraiser miami-dade broward palm beach south florida real estate appraisal LLC sfreappraisal michael p jacobs mai www.sfreappraisal.com Created Date …

The commercial real estate valuation model template can be used to quickly value a commercial property such as an office building, industrial site, logistics or storage or a retail building via DCF valuation.

2 Master of Science thesis Title Value of Commercial Real Estate investments: Sustainability perspective in Sweden and France. Authors Daria Bryunina

working knowledge of the core elements, tools and processes of commercial real estate valuation applicable to retail, office, and special trading properties, as well as development land. It covers: introduction to commercial valuation; lease contracts; income approaches to valuation; comparable sales approaches; valuation reporting.

Find commercial properties for lease in Australia. View the latest commercial real estate listings of Australia properties for lease.

SagePoint Valuation Appraiser Commercial Appraiser

Independent commercial and residential property valuation

Commercial real estate, which includes o¢ce, retail, industrial, apartment and hotel properties, represents a signi…cant fractionofthe investment universe. 1 The ultimate value of commercial real estate emanates from its rental ‡ow, which re‡ects the

Commercial Real Estate Sample Calculations The following examples illustrate how to use the real estate formulas. In Example No.1 the information is obtained for the property and the financial measures calculated. In Example No. 2 the financial measures such as the Cap Rate are obtained for comparable sales and are used to calculate the Market Value for the subject property. Example No 1. Sale

Realty Advisors Residential and Commercial Real Estate Appraisers have provided our clients with accurate and reliable real estate appraisal s Learn More >> O ur appraisal reports include well supported fair market value conclusions, completed by a qualified Larimer County commercial real estate appraiser.

The extent of the assignment given by Jones Lang LaSalle is limited to real estate valuation. This includes office, storage, warehouse, logistics, residential, retail and some extent leasehold properties.

This paper investigates the role of fundamentals and investor sentiment in commercial real estate valuation. In real estate markets, heterogeneous properties trade in illiquid, highly segmented

Commercial Appraisal Desk Review Notice of Use: The appraisal Desk Review form assists the Reviewer in determining if the appraisal is well written, the calculations are correct, the reasoning is sound, and the value conclusions are well supported.

1 Commercial Real Estate Valuation: Fundamentals versus Investor Sentiment Introduction Classical finance theory posits that prices of assets traded in relatively frictionless markets reflect

PDF This paper investigates the role of fundamentals and investor sentiment in commercial real estate valuation. In real estate markets, heterogeneous properties trade in illiquid, highly

Zaxia is an online valuation system for commercial real estate. It is designed and field-tested by experienced commercial appraisers. With your inputs, our ten-minute survey generates a step-by-step analysis using proven methods of valuation. Try Zaxia now.

Two of the three main methods of valuation used by commercial valuers, when used together, will give a reliable commercial real estate value figure to offer as either a selling or a buying price for a commercial property.

valuation errors in the acquisition or the disposition of properties. Further, the idiosyncratic risk is negatively related to the performance of commercial real estate investments. A 10% increase in the national real estate return would reduce the risk by about 0.8%. This paper seems to make two important contributions to the literature. First, the empirical results provide original evidence

Commercial Real Estate Valuation Software Property Metrics

Commercial Real Estate Valuation

The sector is still battling the trifecta of potentially higher rates, an aging real estate cycle, and the market’s focus on growth over value (though this last leg of the trifecta is showing signs of weakening).

19/07/2018 · The value of commercial real estate can be assessed using a variety of different methods and techniques. The cost approach, market approach and income capitalization approach are the three most

valuation errors in the acquisition or the disposition of properties. Further, the idiosyncratic risk is negatively related to the performance of commercial real estate investments. A 10% increase in the national real estate return would reduce the risk by about 0.8%. This paper seems to make two important contributions to the literature. First, the empirical results provide original evidence

The text explains how valuation professionals can identify and value green property features in new and existing commercial properties(2017).Print/PDF

Commercial real estate, which includes o¢ce, retail, industrial, apartment and hotel properties, represents a signi…cant fractionofthe investment universe. 1 The ultimate value of commercial real estate emanates from its rental ‡ow, which re‡ects the

This paper investigates the role of fundamentals and investor sentiment in commercial real estate valuation. In real estate markets, heterogeneous properties trade in illiquid, highly segmented

2 Master of Science thesis Title Value of Commercial Real Estate investments: Sustainability perspective in Sweden and France. Authors Daria Bryunina

Commercial Real Estate Valuation Software Valuation is an important step an any commercial real estate transaction, but comes with many challenges and risks. Excel is cumbersome and error-prone, and can’t easily model complex lease structures that include reimbursements, expirations, market leasing assumptions, and other standard lease terms.

Commercial Real Estate Sample Calculations The following examples illustrate how to use the real estate formulas. In Example No.1 the information is obtained for the property and the financial measures calculated. In Example No. 2 the financial measures such as the Cap Rate are obtained for comparable sales and are used to calculate the Market Value for the subject property. Example No 1. Sale

This paper investigates the role of fundamentals and investor sentiment in commercial real estate valuation. In real estate markets, heterogeneous properties trade in illiquid, highly segmented and informationally inefficient local markets. Moreover, the inability to short sell private real estate

the commercial and residential real estate literature that the value of a property in a given metropolitan area is a function of demographic, local economic and geographic determinants (Capozza et al ., 2002; Abraham and Hendershott, 1996; Lamont and Stein,

Real Estate & Commerical Property Business Valuation