Types of real estate investment pdf

Defining Investment and Investor: Who Is Entitled to Claim? by with a list of specific types of covered investments that is indicative rather than definitive. Recent U.K. treaties define investment as “every kind of asset”, introducing the list of specific forms of investment with the indicative phrase “and in particular, though not exclusively . . . .”2 Recent French BITs use a

The task of analyzing a real estate investment may be divided into three components: 1. In certain types of properties such as office buildings, reserves should be taken for tenant improvements and rental expenses at such times as leases expire. Financial Analysis of Real Property Investments 379-193 3 Elements of the Setup This section looks at each of the elements of the setup, and it

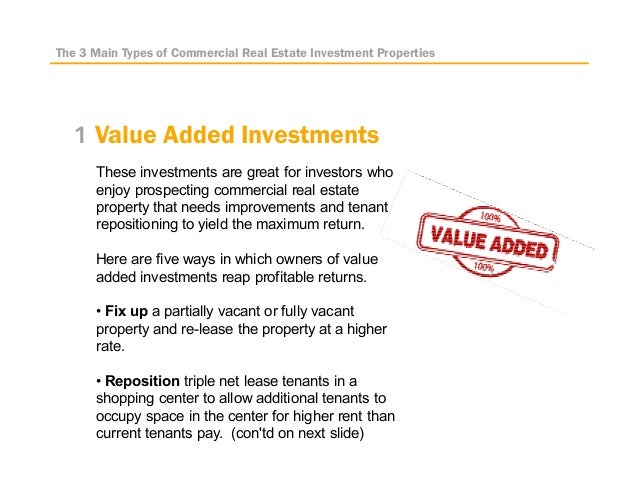

Different Real Estate Investment Strategies 1) Buy and Holds These are good long-term investments because of the steady additional income and the opportunity to gain appreciation.

Examples of real assets include real estate, agricultural land, and precious metals. Real assets are considered part of the “alternative investment” asset class. Investing in real assets can offer: Portfolio diversification due to low correlation with other asset classes Inflation hedge Stable cash flow and long-term capital gain Tangible, enduring impact on the environment and in local

The key is to make the site attractive to the general real estate market. This process can be used to determine if the site is a valuable one, a marginal one, or if it is seriously upside down.

The International Property Handbook from Deloitte’s Global Real Estate & Construction group tracks the flows of real estate capital and provides an overview of investment trends and key deals in the most active global real estate investment markets.

Module 2 Different types of investments Prepared by Pamela Peterson Drake, Ph.D., CFA 1. Overview An investor can invest directly in securities or indirectly.

A real estate broker is a person who helps the seller sells a property; he serves as an intermediary between buyers and sellers. Although they have a big role between the seller and the buyer, a real estate broker does not have the power or right to make important decisions on the client’s behalf.

The real estate industry is an industry in which many of you will have to make some choices about how you will compete in the future. Past modes of behavior probably will not

OVERVIEW 01 Overview The German real estate market is considered an attractive investment area in Europe due to the size of the market and economicstability in the

A real estate investment trust (REIT) is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, ranging from office and apartment buildings to warehouses, hospitals, shopping centers, hotels and timberlands.

For many, real estate investing is uncharted territory. Unlike stocks and bonds — often called “standard assets” — real estate is considered an “alternative asset,” historically difficult to …

The vast majority of real estate agents and brokers work with three major property types accounting for most of the real estate ownership transfers. As a new agent or broker, you may want to narrow your focus and specialize in one or more property types .

Investment research can utilize NCREIF data and analytical tools to support more informed decisions about real estate investment strategy, portfolio construction and asset positioning. – Mark Roberts, Managing Director , Global Head of Research and Strategy, Deutsche Asset Management Alternatives Real …

Property Investment. There are many types of property involved in real estate investing. Almost anyone can imagine buying a house but there are many other options to consider.

2 REAL ESTATE INVESTMENT TRUSTS Real Estate Investment Trusts (REITs) Asset Class Overview The U.S. REIT industry started in 1960 when President Dwight D. …

Bigger Pockets Guide to Real Estate Investing

6 Advantages of Real Estate Investing for Savvy Entrepreneurs

Real estate has three physical characteristics that give land some inherent value. These unique characteristics These unique characteristics are not present as a group in other types of property.

3 TyPES OF REAL ASSETS For the purpose of this paper, we will concentrate on natural resources, infrastructure, and real estate as a broad representation of real assets (see Figure 2).

Council of Real Estate of Investment Fiduciaries (NCREIF) index for that subset of the income- producing sector, but past research suggests that there is more to come, as the public market reliably leads the private market in commercial real estate over the cycle (Gyourko and Keim

Introduction to Real Estate Investment Trusts. Real estate securities •Reasons for adding real estate in investment portfolio: Real estate is globally the biggest asset Presumption is that real estate has low correlation with the rest of financial securities •Investing in real estate has several problems Availability Ticket size Management problems •Hence, intermediated investment

By Peter Conti, Peter Harris . Most people think commercial real estate is all about apartment rentals. Even though residential properties are a big part of commercial real estate investing, other types of properties make for excellent investment opportunities.

The Real Estate Training College aims to provide you with the best quality training available to allow you to easily make the transition into the Real Estate Industry. See Our Website The website at www.retc.com.au contains detailed information about the College and the real estate courses that it offers. Feel free to browse the site and if you are interested either fill out a no-obligation

The main types of market risk are equity risk, interest rate risk and currency risk. + read full definition are equity risk Equity risk Equity risk is the risk of loss because of a drop in the market price of shares. + read full definition, interest rate risk Interest rate risk Interest rate risk applies to debt investments …

The choice of a real estate vehicle will depend on the type of funding that needs to be raised, the proposed investor base, the type of investments to be made and any specific tax considerations. The Luxembourg legal framework is diverse and flexible enough to fulfill a wide range of investor needs. The taxation regime is also a key factor when considering whether to establish an unregulated

private real estate investments and illustrates the beneficial role these assets can play in addressing pension funding issues. Additionally, it examines how real estate’s broad range of investment opportunities can be used to construct diversi-fied real estate allocations to help all types of institutional investors improve the trade-off between dampening portfolio volatility and enhancing

Real Estate Investment Trusts or REITs are entities that own and in most cases operate different types of income producing real estate or related real estate assets, typically consisting of …

Real estate investment trusts are historically one of the best-performing asset classes available. The FTSE NAREIT Equity REIT Index is what most investors use to gauge the performance of the U.S

This type of real estate investing is quite like that of bonds. (To read more about mortgages, see Shopping for a Mortgage, Understanding the Mortgage Payment Structure and Paying Off Your Mortgage.) An equity investment, on the other hand, represents a residual interest in the property. When you are an equity investor, you are essentially the owner of the property. You stand to gain a lot

REAL ESTATE SYNDICATION

Real estate is powerful – but only if you work it right. You must learn how to find great deals, how to evaluate a real estate investment , and how to finance any properties you want to buy.

real estate at the property-level because REITs are collections of individual properties. Measuring Real Estate Before you develop or acquire a property, you must know how big it is – size is the key metric for real estate.

Real estate risk is more complicated than other asset classes due to the: 1) inefficiency, behavioral nature and dual Space-Time, Money-Time dimensions of the market, and 2) the capital-intensive, durable and vulnerable nature of individual assets to external forces.

Much real estate finance occurs at the micro-level of individual investments in properties, projects, or “deals .” Hence, much “capital structure” in real estate occurs at this micro-level.

3/04/2015 · Figure 1: Overview of different types of investments Source: World Economic Forum Investors Industries 2 Alternative Investments 2020: An Introduction to Alternative Investments Private equity buyouts Hedge funds Venture capital Core alternative investments Other alternative investments Private equity infrastructure Private equity real estate Private debt funds Other alternative funds Art

Investing For Dummies arms novice investors with Eric Tyson’s time-tested advice, recommendations, and the latest insights and strategies to wisely invest in today’s market. You’ll get coverage of all aspects of investing, including how to develop and manage a portfolio; invest in stocks, bonds, mutual funds, and real estate; open a small business; and understand the critical tax

Non-productive real estate or real property that is rented out on weekends or holidays or earmarked for lease owned by foreign companies is assumed to belong to individual residents of, or undivided estates located in, Argentina. – real estate business ideas pdf fins5533 – real estate finance and investment The assignment will involve a valuation task on a residential property using the investment valuation techniques covered in class.

Typically, a cash-flow strategy is where the investment property earns more rental income than the cost of mortgage, property management, rates and other maintenance costs. This strategy is generally favoured by many beginner investors, particularly those that are earning lower to average income.

should include both public and private real estate investments. THE CASE FOR REAL ESTATE Before diving into the particulars of the various types of real estate investments, it is important to recognize that real estate, in any of its forms, is a valuable asset in an investor’s portfolio. During the past two years, much investor attention has been focused on the fact that, in many cases

Real estate investors can choose among many types of properties to generate attractive returns. Each property type has its own risk/reward profile, and it’s a great idea to select the types …

Commercial real estate can be broken down into several different categories. At a high level, when people think of different types of commercial real estate, they typically think about shopping centers, office buildings, or warehouses.

Equity Investment in Real Estate Development Projects: A Negotiating Guide for Investors and Developers Meredith J. Kane A good match between a developer and an equity investor requires a balancing of risk, return and investment horizon. THE REAL ESTATE FINANCE JOURNAL /Spring 2001 5. vide equity to development projects. Different types of investors have different levels of risk …

International Property Handbook 2017 trends and a look

Real estate is one of the oldest and most popular asset classes. Most new investors in real estate know that, but what they don’t know is how many different types of real estate investments exist. It goes without saying that each type of real estate investment has its own potential benefits and

Real Estate Investment Trust (REITS) Corporation Summary: Before extended study of real estate, your students should understand the basic concepts of real property. Chapter One defines real property, its forms of ownership and interests. Be sure the students understand the differences in ownership forms. Figures 1-2 and 1-3 should be especially helpful in demonstrating the differences between

MEKETA INVESTMENT GROUP “WHY NON-CORE REAL ESTATE” 5 Property Type Descriptions Real estate varies significantly, not only among property types, but within property type

THE REALITY OF REAL ESTATE prenhall.com

Real estate Alternative no more J.P. Morgan

Real estate investment trusts (“REITs”) have been around for more than fifty years. Congress established . REITs in 1960 to allow individual investors to invest in large-scale, income-producing real estate. REITs provide a way for individual investors to earn a share of the income produced through commercial real estate ownership – without actually having to go out and buy commercial

Financial investment refers to putting aside a fixed amount of money and expecting some kind of gain out of it. It can be in the form of – Mutual Funds, Fixed Deposits, Stocks, Bonds, Equities etc. It can be in the form of – Mutual Funds, Fixed Deposits, Stocks, Bonds, Equities etc.

Capitalization Rate. The capitalization rate, or “cap rate”, is a formula used to determine the value of a real estate investment. The cap rate percentage is found by dividing the net operating income of a real estate asset (expenses minus income) by the current value of the asset.

MEKETA INVESTMENT GROUP “WHY NON ORE REAL ESTATE

The Pros and Cons of Different Real Estate Investments

US Real Estate Indicators Report Lazard Asset Management

Exploring Real Estate Investments i.investopedia.com

Real estate investment trust Wikipedia

columbia valley real estate guide – Top 6 Real Estate Investment Strategies Mashvisor

Types of Commercial Real Estate Property Metrics

Different Types of Real Estate Investments The Balance

RESEARCH Public and Private Real Estate reit

Real estate Alternative no more J.P. Morgan

REAL ASSETS AND IMPACT INVESTING

Introduction to Real Estate Investment Trusts. Real estate securities •Reasons for adding real estate in investment portfolio: Real estate is globally the biggest asset Presumption is that real estate has low correlation with the rest of financial securities •Investing in real estate has several problems Availability Ticket size Management problems •Hence, intermediated investment

The main types of market risk are equity risk, interest rate risk and currency risk. read full definition are equity risk Equity risk Equity risk is the risk of loss because of a drop in the market price of shares. read full definition, interest rate risk Interest rate risk Interest rate risk applies to debt investments …

The Real Estate Training College aims to provide you with the best quality training available to allow you to easily make the transition into the Real Estate Industry. See Our Website The website at www.retc.com.au contains detailed information about the College and the real estate courses that it offers. Feel free to browse the site and if you are interested either fill out a no-obligation

Property Investment. There are many types of property involved in real estate investing. Almost anyone can imagine buying a house but there are many other options to consider.

fins5533 – real estate finance and investment The assignment will involve a valuation task on a residential property using the investment valuation techniques covered in class.

Much real estate finance occurs at the micro-level of individual investments in properties, projects, or “deals .” Hence, much “capital structure” in real estate occurs at this micro-level.

Real estate investment trusts (“REITs”) have been around for more than fifty years. Congress established . REITs in 1960 to allow individual investors to invest in large-scale, income-producing real estate. REITs provide a way for individual investors to earn a share of the income produced through commercial real estate ownership – without actually having to go out and buy commercial

2 REAL ESTATE INVESTMENT TRUSTS Real Estate Investment Trusts (REITs) Asset Class Overview The U.S. REIT industry started in 1960 when President Dwight D. …

Introduction to Real Estate Investment Trusts

6 Advantages of Real Estate Investing for Savvy Entrepreneurs

Non-productive real estate or real property that is rented out on weekends or holidays or earmarked for lease owned by foreign companies is assumed to belong to individual residents of, or undivided estates located in, Argentina.

Typically, a cash-flow strategy is where the investment property earns more rental income than the cost of mortgage, property management, rates and other maintenance costs. This strategy is generally favoured by many beginner investors, particularly those that are earning lower to average income.

fins5533 – real estate finance and investment The assignment will involve a valuation task on a residential property using the investment valuation techniques covered in class.

Real estate risk is more complicated than other asset classes due to the: 1) inefficiency, behavioral nature and dual Space-Time, Money-Time dimensions of the market, and 2) the capital-intensive, durable and vulnerable nature of individual assets to external forces.

A real estate broker is a person who helps the seller sells a property; he serves as an intermediary between buyers and sellers. Although they have a big role between the seller and the buyer, a real estate broker does not have the power or right to make important decisions on the client’s behalf.

3/04/2015 · Figure 1: Overview of different types of investments Source: World Economic Forum Investors Industries 2 Alternative Investments 2020: An Introduction to Alternative Investments Private equity buyouts Hedge funds Venture capital Core alternative investments Other alternative investments Private equity infrastructure Private equity real estate Private debt funds Other alternative funds Art

Real Estate Investment Trust (REITS) Corporation Summary: Before extended study of real estate, your students should understand the basic concepts of real property. Chapter One defines real property, its forms of ownership and interests. Be sure the students understand the differences in ownership forms. Figures 1-2 and 1-3 should be especially helpful in demonstrating the differences between

Defining Investment and Investor: Who Is Entitled to Claim? by with a list of specific types of covered investments that is indicative rather than definitive. Recent U.K. treaties define investment as “every kind of asset”, introducing the list of specific forms of investment with the indicative phrase “and in particular, though not exclusively . . . .”2 Recent French BITs use a

OVERVIEW 01 Overview The German real estate market is considered an attractive investment area in Europe due to the size of the market and economicstability in the

REAL ESTATE INVESTMENT TRUSTS Research Affiliates

Introduction to Real Estate Investment Trusts

Investing For Dummies arms novice investors with Eric Tyson’s time-tested advice, recommendations, and the latest insights and strategies to wisely invest in today’s market. You’ll get coverage of all aspects of investing, including how to develop and manage a portfolio; invest in stocks, bonds, mutual funds, and real estate; open a small business; and understand the critical tax

The choice of a real estate vehicle will depend on the type of funding that needs to be raised, the proposed investor base, the type of investments to be made and any specific tax considerations. The Luxembourg legal framework is diverse and flexible enough to fulfill a wide range of investor needs. The taxation regime is also a key factor when considering whether to establish an unregulated

The task of analyzing a real estate investment may be divided into three components: 1. In certain types of properties such as office buildings, reserves should be taken for tenant improvements and rental expenses at such times as leases expire. Financial Analysis of Real Property Investments 379-193 3 Elements of the Setup This section looks at each of the elements of the setup, and it

Real estate investors can choose among many types of properties to generate attractive returns. Each property type has its own risk/reward profile, and it’s a great idea to select the types …

fins5533 – real estate finance and investment The assignment will involve a valuation task on a residential property using the investment valuation techniques covered in class.

2 REAL ESTATE INVESTMENT TRUSTS Real Estate Investment Trusts (REITs) Asset Class Overview The U.S. REIT industry started in 1960 when President Dwight D. …

Introduction to Real Estate Investment Trusts

The case for investing in U.S. core real estate lasalle.com

Real estate has three physical characteristics that give land some inherent value. These unique characteristics These unique characteristics are not present as a group in other types of property.

2 REAL ESTATE INVESTMENT TRUSTS Real Estate Investment Trusts (REITs) Asset Class Overview The U.S. REIT industry started in 1960 when President Dwight D. …

The Real Estate Training College aims to provide you with the best quality training available to allow you to easily make the transition into the Real Estate Industry. See Our Website The website at www.retc.com.au contains detailed information about the College and the real estate courses that it offers. Feel free to browse the site and if you are interested either fill out a no-obligation

Real estate risk is more complicated than other asset classes due to the: 1) inefficiency, behavioral nature and dual Space-Time, Money-Time dimensions of the market, and 2) the capital-intensive, durable and vulnerable nature of individual assets to external forces.

Real estate investors can choose among many types of properties to generate attractive returns. Each property type has its own risk/reward profile, and it’s a great idea to select the types …

Real Estate Investment Trust (REITS) Corporation Summary: Before extended study of real estate, your students should understand the basic concepts of real property. Chapter One defines real property, its forms of ownership and interests. Be sure the students understand the differences in ownership forms. Figures 1-2 and 1-3 should be especially helpful in demonstrating the differences between

The real estate industry is an industry in which many of you will have to make some choices about how you will compete in the future. Past modes of behavior probably will not

By Peter Conti, Peter Harris . Most people think commercial real estate is all about apartment rentals. Even though residential properties are a big part of commercial real estate investing, other types of properties make for excellent investment opportunities.

Typically, a cash-flow strategy is where the investment property earns more rental income than the cost of mortgage, property management, rates and other maintenance costs. This strategy is generally favoured by many beginner investors, particularly those that are earning lower to average income.

For many, real estate investing is uncharted territory. Unlike stocks and bonds — often called “standard assets” — real estate is considered an “alternative asset,” historically difficult to …

The key is to make the site attractive to the general real estate market. This process can be used to determine if the site is a valuable one, a marginal one, or if it is seriously upside down.

MEKETA INVESTMENT GROUP “WHY NON-CORE REAL ESTATE” 5 Property Type Descriptions Real estate varies significantly, not only among property types, but within property type

Council of Real Estate of Investment Fiduciaries (NCREIF) index for that subset of the income- producing sector, but past research suggests that there is more to come, as the public market reliably leads the private market in commercial real estate over the cycle (Gyourko and Keim

Real Estate Investment Trusts or REITs are entities that own and in most cases operate different types of income producing real estate or related real estate assets, typically consisting of …

A Guide to Real Estate Investment in Germany

REAL ESTATE INVESTMENT TRUSTS Research Affiliates